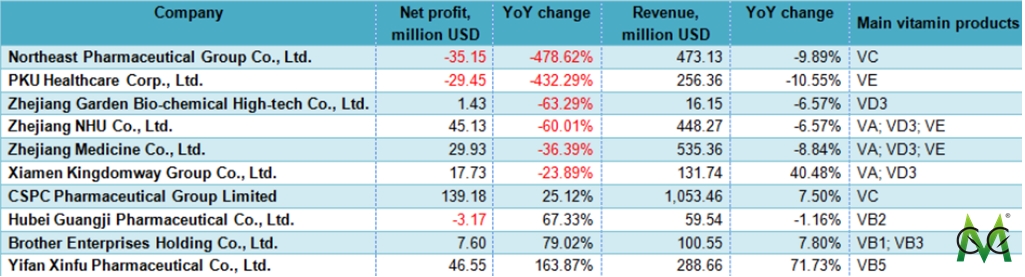

According to CCM, about 70% of vitamin enterprises recorded declining performance or even made losses, especially in VA, VE and VD3 enterprises, showed by Q1-Q3 financial reports issued by domestic listed vitamin enterprises. Throughout Chinese vitamin Industry, most of vitamin enterprises are plagued by overcapacity, environmental issues and low value-added products.

From end of Oct. to beginning of Nov. 2015, Chinese listed vitamin enterprises had published Q1-Q3 financial reports in succession. Overall, most of vitamin enterprises performed unsatisfactory in Q1-Q3. Among 10 listed vitamin enterprises in China, 70% of vitamin enterprises announced declining performance or even suffered losses.

Performance of main listed vitamin enterprises in China, Q1-Q3 2015

Source: Company reports

The domestic vitamin enterprises, which recorded declining performance or made losses, are especially concentrated in VA, VE and VD3 industries. VA, VE and VD3 are mainly applied in feed. According to CCM's statistics, feed accounts for as high as 91% of VD3 downstream application in China, also, it takes up as high as 83% and 66% in VA and VE, respectively.

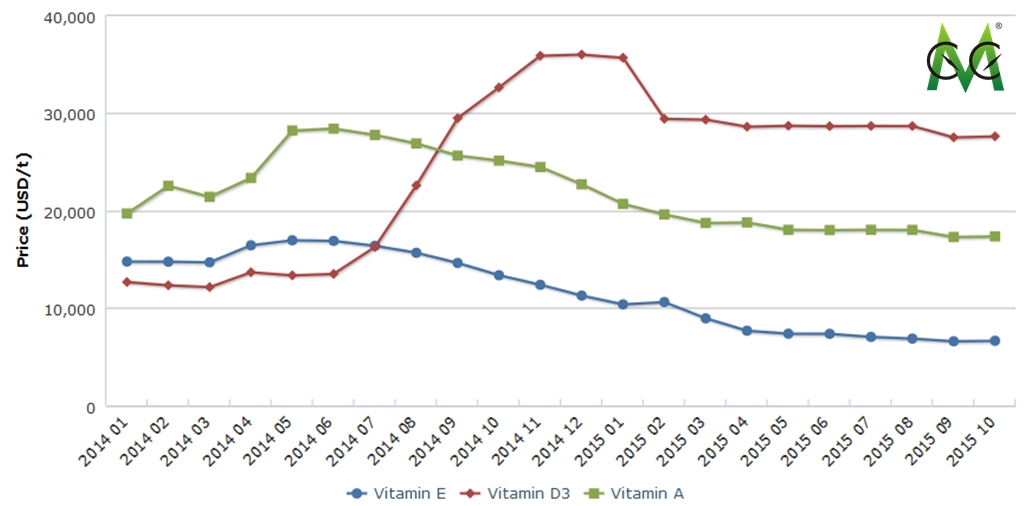

Since Jan. 2015, along with decreasing number of raised poultry and livestock, feed industry is slowing down, leading to poor sales of feed. Therefore, the sales and price of feed grade vitamins dampened. According to the monitoring data in the 4,000 designated points conducted by the Ministry of Agriculture of the People's Republic of China (MOA), from Jan. to Sept. 2015, the monthly number of live pig in farm posted a decreasing rate of exceeding 10% compared with each prior-year month. In this period, the market prices of VA and VE fell significantly year on year, but that of VD3 rose year on year, according to CCM’s price monitoring. Zhejiang Garden Bio-chemical High-tech Co., Ltd. suspended cholesterol production, it imported high-priced raw material for VD3 production, thus to increase the production cost and narrow down the gross profit of VD3.

In Jan.-Sept., average market prices showing:

-

Feed grade VA (500,000 IU/g): USD18,539.22/t (RMB117,082.59/t), down by 25.31% YoY

-

Feed grade VE (50%, powder): USD8,085.44/t (RMB51,062.79/t), down by 48.38% YoY

-

Feed grade VD3 (500,000IU/g): USD29,403.22/t (RMB185,693.10/t) , up by 81.56% YoY

Market price of VE, VD3 and VA in China, Jan. 2014-Oct. 2015

Note: VE: 50% powder, feed grade

VD3: 500,000IU/g feed grade

VA: 500,000 IU/g feed grade

Source: CCM

Throughout Chinese vitamin Industry, most of vitamin enterprises are confronted with troubles.

Overcapacity

Since 2015, some domestic vitamin products are under fast growth. Enterprises are seizing the limited market share, triggering price war and squeezing down price with each other. As a result, enterprises themselves benefits are damaged. Currently, VA, VC and VE are overcapacity in China. In 2014, VC capacity was about 205,000 t/a and its output approximated 135,000 tonnes, whose utilization of capacity was 65.82%.

Environmental issues

Vitamin enterprises are highly polluted ones. This is the reason that Europe and the US demonstrate strong demand for vitamins but decreasing capacity. Take VB9 (folic acid) as an example, the domestic output was 1,370 tonnes in 2014, over 70% of which were exported to Europe and the US. In recent years, Europe and the US are gradually reducing VB9 capacity, and now they almost stop production. The government' supervision and regulation on pollution are strengthening, the environment protection cost on enterprises is consequently increased, the operating rate is decreased and the output of VB9 is dropped.

Low added value

Despite the fact that China has become the largest vitamin producer in the world, it focuses on low value-added APIs (Active Pharmaceutical Ingredients). Chinese vitamin enterprises have low profitability and have a weak voice in pricing. So, more and more vitamin enterprises are making business transformation.

CCM maintained that Chinese vitamin enterprises put efforts to cope with difficulties.

Firstly, enterprises actively develop vitamin derivatives or downstream products to increase product value.

Secondly, enterprises improve their sewage treatment capability to address the increasingly stringent environmental requirements. Also, to transfer other countries and launch production in their regions will be a worthwhile option.

Thirdly, enterprises reduce the dependence to downstream feed industry and enlarge application range, so as to strengthen their anti-risk ability.

If you want to know more about the Vitamins industry, you can have a look at our product: Vitamins China News.

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailingecontact@cnchemicals.com or calling +86-20-37616606.