CCM predicted that China’s import volume of DDGS would reduce dramatically in 2016 because China is boosting

the consumption of domestic corn and

the imported DDGS is overstocked at ports.

Along with

the slumping corn price in China, imported substitutes for corn no longer have

advantage. The import volumes of DDGS, sorghum and barley gradually decline. In

Oct., the import volumes were,

-

DDGS: 660,193 tonnes, a MoM fall of 29.21%;

-

Sorghum: 681,868 tonnes, a MoM fall of 36.12%;

-

Barley: 998,367 tonnes, a MoM fall of 22.91%.

Besides the decreasing cost performance, the policy is another factor led to

the declining import volume of DDGS.

Currently, China’s imported DDGS is still

in the shadows of anti-dumping investigation. Many Chinese traders have reduced

the import volume due to the rumor of anti-dumping. Additionally, Chinese

government initiated the automatic import license system on imported DDGS since

1 Sept., 2015. Many traders could not obtain import licenses because of the

strict requirements and cumbersome application procedures.

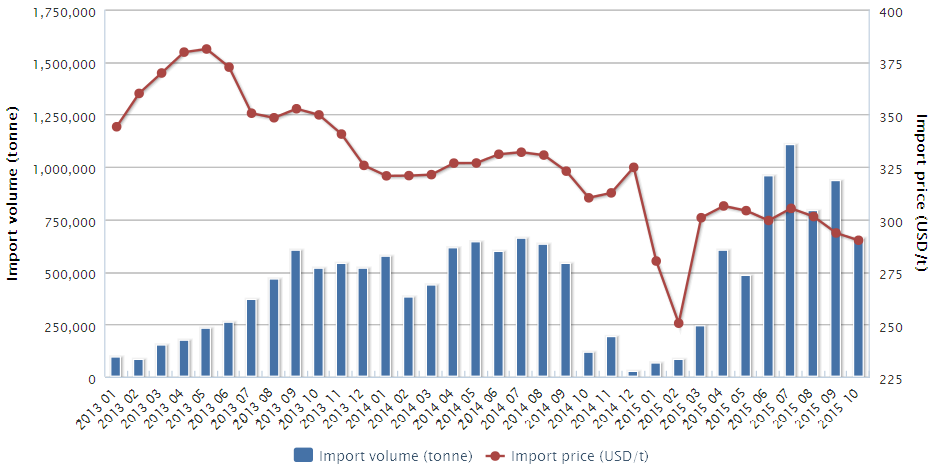

China's imports of

DDGS in Jan. 2013-Oct. 2015

Source: China Customs

As the end of 2015

comes, it is predicted that the import volume of DDGS would reduce sharply in

2016.

Increasing import volume of substitutes for corn goes against Chinese policy

It cannot be denied that Chinese government has strong control power on the

market. Reviewing the import history in recent two years, in Oct. 2014, Chinese

government banned the imported genetically modified (GM) DDGS (MIR162), which

significantly pulled down the import volume from 539,000 tonnes in Sept. to

26,000 tonnes in Dec., decreasing by over 500,000 tonnes.

Then in Dec. 2014,

the government announced to lift the ban on GM DDGS (MIR162) and then the

import volume rebounded to 243,000 tonnes. Notably, policy plays an important

role in the import market of DDGS.

In fact, Chinese government does not expect imported DDGS to squeeze the

domestic corn market because this will hinder the government to boost the

consumption of domestic corn. Therefore, it is estimated that Chinese

government would strengthen the automatic import approval on DDGS in the

future.

Meantime, the 13th Five-year Plan shows that the import market

of substitutes for grains will be limited in the future. It is pointed out that

ensuring the grain safety would be an eternal topic in China.

Increasing import volume of substitutes for corn does not come in line with

Chinese market status

Import volume of DDGS hit record high in June-Sept. 2015. However, the sluggish

downstream livestock market did not recover completely. The poor sales led to

overstocked inventory at ports. According to China Customs, at the end of Nov.,

the inventory of imported DDGS reached about 1.32 million tonnes at China’s

major ports, approaching the highest record - 1.36 million tonnes. How to

quickly consume the imported DDGS at ports becomes a greatest difficulty for

traders.

For this, part of import traders has conducted price-off promotions. The

quotation was about USD295/t, which was lower than the purchase price. Some

traders have suffered losses and some even disclosed that they are likely to

exit the DDGS trading market in 2016 under losses and unclear policy.

Under the slow-growing

economy in China, the price trend of corn, whether the anti-dumping

investigation can be put on record and the DDGS inventory at ports at the end

of 2015 will be the influential factors on the import volume of DDGS in 2016.

Nevertheless, the current situation is not optimistic. Since China encourages

the consumption of domestic corn, corn price will remain at low level in 2016.

Homemade DDGS enjoys low production cost, which will squeeze the market space

of imported one.

In Jan.-Oct., China imported 5.93 million tonnes of DDGS,

sourced from China Customs. Based on the inventory and policy, the figure will

further decline in Nov. and Dec. It is preliminary estimated that the total

import volume is around 6.30 million tonnes in 2015 and the figure will record

a YoY drop of 20% in 2016.

If you would like to know more about the DDGS industry, you could have a look at our product: Corn Product China News.

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.

Tag: DDGS corn