In December 2015, Do-Fluoride’s subsidiary decided to stop the cryolite production line. Given Do-Fluoride’s cutting of its AlF3 capacity earlier plus

its leading role in the industry, the elimination of the mid- and low-end

capacity in China’s inorganic fluoride salt industry is at the beginning,

according to CCM.

On 3 Dec., 2015, Do-Fluoride Chemicals Co., Ltd. (Do-Fluoride) announced that

it had informed by its subsidiary Do-Fluoride (Kunming) Technology Development

Co., Ltd. [Do-Fluoride (Kunming)] that the latter decided to officially stop

the cryolite production line from early December in order to limit production

and support the price.

Established in Anning City, Yunnan Province in 2012 with USD15.63 million

(RMB100 million) registered capital, Do-Fluoride (Kunming) is a joint venture

of Do-Fluoride, Yunnan Xiangfeng Jinmai Chemical Co., Ltd. and Anning Yinchuan

Chemical Co., Ltd.

In October 2015, Do-Fluoride held the 23rd Session, 4th Board Meeting at which

the proposal of reducing the production scale of aluminium fluoride (AlF3) was

unanimously passed.

According to the proposal, Do-Fluoride will first remove one AlF3 production

line and continue to reduce AlF3 output in the future so as to keep normal

operation with only one production line at its headquarters (Jiaozuo City,

Henan Province). Currently, Do-Fluoride's total capacity of AlF3 is 120,000

t/a, only 2 out of 4 production lines in operation.

According to CCM research, the elimination of the mid- and low-end capacity in

China's inorganic fluoride salt industry is at the beginning under the

influence of the leading enterprise Do-Fluoride.

To be specific, the elimination of the mid- and low-end capacity is due to the

facts that the domestic inorganic fluoride salt industry has been stuck by the

structural disequilibrium (excessive mid- and low-end capacity and insufficient

high-end capacity) and the vicious competition, which forced the prices of

mainstream products to fall and constantly suppressed enterprises’

profitability.

As the economic growth further slowed down in 2015, inorganic fluoride salt

market continued to suffer from heavy pressure of sluggish demand. For example:

1. Cryolite

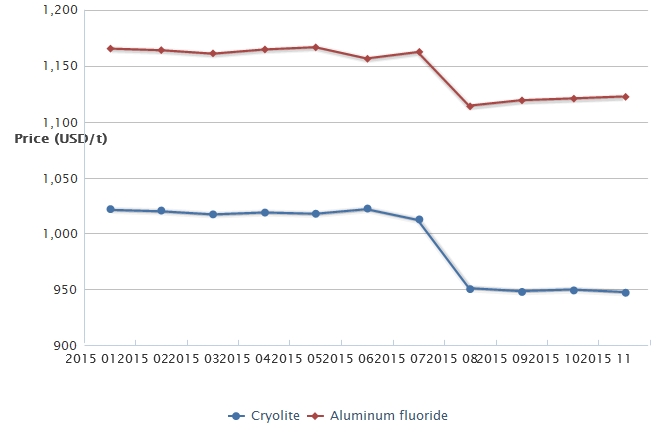

By November 2015, the average ex-works price of cryolite had dropped 7.28%

compared with that early this year. Relevant manufacturers faced far heavier

sales pressure compared with 2014. For one thing, the demand for building

materials was low as the real estate economy is depressed; for another, the spot

market price of aluminium kept falling and the electrolytic aluminium enterprises

saw low rate of operation.

2. AlF3

By November 2015, the average ex-works price of AlF3 had decreased 3.73%

compared with that early this year. As a result of low rate of operation in the

downstream electrolytic aluminium enterprises, relevant manufacturers were

under great pressure of shipping and the profit margin was continuously

narrowed.

Moreover, with the enforcement of the Environmental Protection Law in 2015,

inspection on environmental protection is stricter, cost from environmental protection

increased, and the operation costs of inorganic fluoride salt enterprises grew

as well.

Under such high operation pressure, domestic inorganic fluoride salt

enterprises frequently closed down. According to CCM’s statistics, by November

2015:

- The average capacity utilisation rate of cryolite was about 30-40%

- The average capacity utilisation rate of AlF3 was about 40-50%

- The average capacity utilisation rate of other inorganic fluoride salts was

about 50-60%

Ex-works price of cryolite and AlF3 in

China, January–November 2015

Note: AlF3 stands for aluminium fluoride

Source: CCM

Nonetheless, the high-end inorganic fluoride salt products market is in good

shape, which raises hope amongst enterprises. With the rapid development of

alternative energy, electronic information and medical treatment industries,

both the production and sales of the supporting products, fluorochemicals at

electronic, optical and pharmaceutical grades are boosted with the prices

rising and net profit staying high, according to CCM.

For instance, with the explosive development of Li-ion battery and the

downstream alternative energy vehicle this year, the demand for lithium

hexafluorophosphate (LiPF6), core raw material for Li-ion battery, greatly

increased and outstripped the supply, which triggered the prices rise by 70%

compared with that early this year and the constant rising is likely to reach

100% throughout the year.

Therefore, enterprises have reacted to the market accordingly by making

high-end capacity layout. Take Do-Fluoride for example. It is reducing its AlF3

capacity in order to eliminate the idle capacity and improve operation

efficiency and at the same time to make room for LiPF6 capacity expansion.

Do-Fluoride will construct a 3,000 t/a LiPF6 production line in the place where

AlF3 production lines were removed. This will help the company solve the

problem that it will be unable to meet the order demands in the future (in

September, it could meet only 60% orders). In the meanwhile, this will enhance

the scale effect, seize the opportunity to profit and make contributions to the

overall business performance.

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc. More about CCM, please visit www.cnchemicals.com.

China

Refrigeration is one of the leading exhibitions in the world for

refrigeration, air-conditioning, heating and ventilation, frozen food

processing, packaging and storage. It will take place on 3 days from Thursday, 07. April to Saturday, 09. April 2016 in Beijing.

We will attend China Refrigeration Beijing in the coming month. If you would like to meet us for consultancy in China Refrigeration Beijing, please get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.