In March 2016, Shenghua Biok released its 2015 financial figures. Revenue from tryptophan

business decreased out of the drops in both sales volume and price. In 2016,

Shenghua Biok will focus on "pan-entertainment" business to hunt for

new profit growth.

In

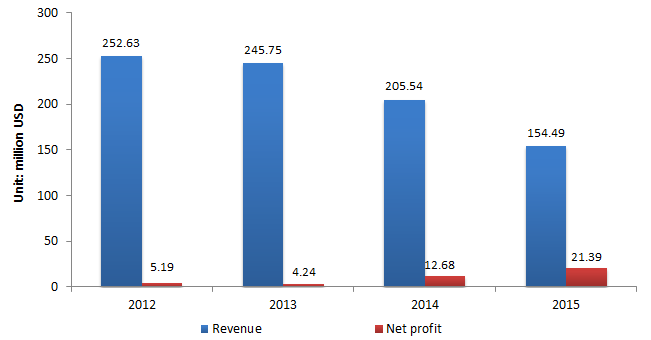

March 2016, Zhejiang Shenghua Biok Biology Co., Ltd. (Shenghua Biok) released

its 2015 financial figures. Its revenue was USD154.49 million (RMB1.01

billion), down by 24.84% over 2014, while the net profit reached USD21.39

million (RMB139.88 million), up by 68.73% YoY. This is mainly because the

company had sold its loss-making subsidiary.

Particularly,

Shenghua Biok's revenue from veterinary drug business (mainly tryptophan)

reduced by 12.03% to USD68.66 million (RMB448.95 million), due to:

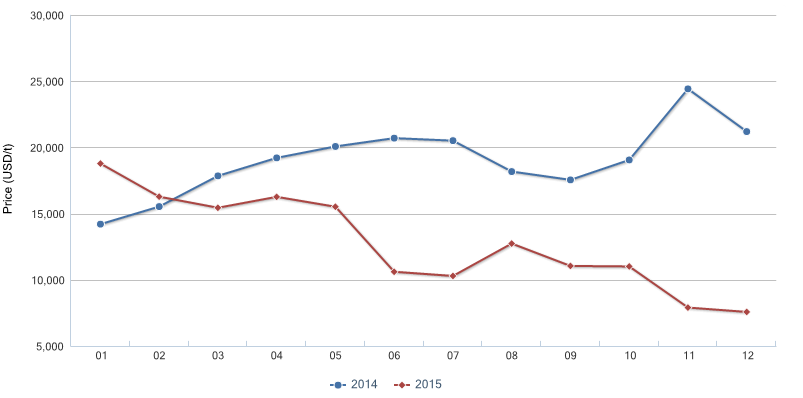

According to CCM’s price monitoring, the market price of 98% tryptophan

continued sliding in 2015: from USD18,793/t in Jan. to USD7,581/t in Dec.,

shrinking by 60%.

-

Fall

in production and sales volume

Accordingly, both figures were down compared with 2014:

-

Production:

1,171.50 tonnes, down by 23.11%

-

Sales

volume: 966.12 tonnes, down by 31.04%

-

Stock

(by 31 Dec. 2015): 346.02 tonnes, up by 146.03%

This slump was mainly affected by the price downturn in soybean meal, a raw

material for protein feed. CCM’s data showed that the market price of soybean

meal was USD417/t, declining by 17% compared with Jan. As a substitute for

tryptophan, downstream feed industry chose the cheaper soybean meal to reduce

cost, which led to the sluggish sales and falling price of tryptophan.

For

this, Shenghua Biok optimized its manufacturing techniques to lower the cost.

The gross profit margin thus rose to 17.41%, up by 5.49 percentage points,

which, however, couldn’t offset the negative effect from the slump in

tryptophan’s price.

Shenghua Biok's

financial performance, 2012-2015

Source: Zhejiang Shenghua Biok Biology Co., Ltd.

Monthly market price

of 98% tryptophan in China, Jan. 2014-Dec. 2015

Source: CCM

Shenghua

Biok has stood firm in China’s tryptophan market by enlarging scale. According

to CCM’s research, domestic tryptophan enterprises able to realize mass

production include Meihua Holdings Group Co., Ltd., Henan Julong Bioengineering

Co., Ltd. and Shenghua Biok, taking up 65%+ of the sales. Shenghua Biok’s

output of tryptophan was merely around 200 tonnes in 2013, but to 1,000 tonnes

in 2015.

At

present, the tryptophan business was the biggest contributor to Shenghua Biok.

Other products, with low gross profit margin and small scale, can’t bring any

new growth point of profit. Therefore, in 2016 Shenghua Biok will:

-

Innovate

in techniques to reduce production cost and boost profits

-

Speed

up to abolish businesses and sections with serious losses and weak

competitiveness

-

Hunt

for new engines of growth by focusing on pan-entertainment business* as a

strategic business

Notably, “We will restart the plan to acquire 100% of shares in Chengdu Blaze

Loong Technology Co., Ltd., which will enhance our profitability,” Shenghua

Biok mentioned in the 2015 financial report (Please see Shenghua Biok fails

in reconstructing in Amino Acids China E-News 1602).

*Pan-entertainment

business: first put forward by Tencent, it makes profits on Internet by

attracting fans in fields of online computer games, literature, comics, movie,

etc. Shenghua Biok is attempting to step into online games industry by

acquiring Chengdu Blaze Loong Technology Co., Ltd.

About CCM:

CCM is the leading

market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to

industry newsletters and customized market research reports. Our clients

include Monsanto, DuPont, Shell, Bayer, and Syngenta.

We will

attend FIC in this week. If you would like to meet us for consultancy in

FIC, please get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.

Tag: Shenghua Biok, tryptophan