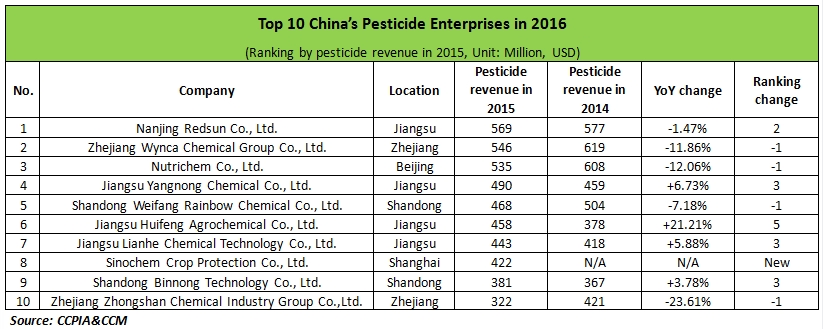

Based on total pesticide revenue of the

enterprises in 2015, China Crop Protection Industry Association (CCPIA)

published the 2016 List of Top 100 Pesticide Enterprises in China. Here, CCM presents you the rank of Top 10 Pesticide

Enterprises in China from CCPIA’s list.

The total combined revenue of these top 10

pesticide enterprises reached USD4.634 billion, down 8% YoY compared to that of

the top 10 pesticide enterprises in the 2015 List. Of the top 10, 5 recorded

falling revenues, 4 had increasing revenues and the remaining 1 was a newcomer

to the list.

On the 2016 List, the top three enterprises

were the same as on the 2015 List, but ranked differently. Nanjing Redsun Co.,

Ltd. climbed to the top from No.3 with a revenue of USD569 million (down by

1.47% YoY), followed by Zhejiang Wynca Chemical Group Co., Ltd. (Zhejiang

Wynca, USD546 million, down by 11.86% YoY) and Nutrichem Co., Ltd. (USD535

million, down by 12.06% YoY).

Zhejiang Wynca’s decreasing revenue in 2015

was mainly because of the low glyphosate price. Many domestic pesticide

enterprises that were engaged in the production of glyphosate suffered a

significant decline in revenue, such as Fuhua Tongda Agro-chemical Technology

Co., Ltd., Jiangsu Good Harvest-Weien Agrochemical Co., Ltd., Zhejiang Wynca,

Hubei Sanonda Co., Ltd., and Shandong Weifang Rainbow Chemical Co., Ltd.

However, Jiangsu Yangnong Chemical Co.,

Ltd. was also mainly engaged in the production of glyphosate but losses from its

glyphosate business in 2015 were offset by revenue from its hygienic

insecticide business and income from new projects of its subsidiary, Jiangsu

Youjia Crop Protection Co., Ltd.

As for the newcomer, Sinochem Agro, which

ranked 15th on the 2015 List, and Sinochem Crop Protection Co., Ltd.

(Sinochem Crop Protection), are both subsidiaries of Sinochem International

Corporation. After business integration in 2015, Sinochem Crop Protection

became the controlling shareholder of Sinochem Agro and ranked 8th on the 2016 List with a revenue of USD422 million.

In fact, the domestic pesticide market grew

slower than in previous years in China. Combined total revenue of the 829

pesticide enterprises with an annual revenue of over RMB20 million from their

main business operations hit USD49.90 billion, with a YoY growth rate of 1.88%;

There are some factors behind the falling

pesticide market in 2015, such as the downturn in the global pesticide market

and the depressed herbicide market in China. To be more specific, according to

Phillips McDougall, a crop protection research company, the total revenue from

the global pesticide industry in 2015 reached USD58.18 billion, down by 8% YoY.

During 2011-2015, output of herbicide technical took up roughly 50% of the

total pesticide technical output every year in China. However, herbicide price

in 2015 was low, especially that of glyphosate and paraquat, leading to a huge

hit to the China’s pesticide industry.

Against such circumstances, some enterprises, Jiangsu Huifeng Agrochemical Co.,

Ltd., managed to make increasing revenue thanks to their balanced product

structure and their innovative marketing methods. In general, performance of

China’s pesticide industry in 2015 was worse than that in previous years, but

many domestic enterprises are still be able to achieve progress.

Predicting the ranking list in 2017, Li

Biyan, agrichemical researcher of CCM,

stated that: “It is not likely that these 10 pesticide enterprises would edge

out of the ranking list as they are all leading pesticide enterprises in China.”

If you are interested in the pesticide

enterprises in China, you could have a look at our newly published report: 2016

Top 100 Pesticide Enterprises in China.

The report of China 2016 Top 100 Pesticide

Enterprises is an analysis report about the ranking lists of the China's

pesticide industry, including the lists of China 2016 Top 100 Pesticide

Enterprises, China 2016 Top 30 Pesticide Formulation Enterprises and China Top

Selling Pesticide Brands in 2015.

From this report, you will be able to find

your answers as we will show you:

--Lists of China 2016 Top 100 Pesticide

Enterprises

--China 2016 Top 30 Pesticide Formulation

Enterprises

-- China Top Selling Pesticide Brands in

2015

--China's pesticide industry in 2015

-- Geographic distribution of top 100

pesticide enterprises

-- Industrial concentration of China's

pesticide industry still way off target

--Reasons for growth and decline in revenue

About CCM:

CCM is the leading market intelligence provider for China’s

agriculture, chemicals, food & ingredients and life science markets.

Founded in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research reports.

Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a

brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.