Affected by the ongoing state

storage and purchase tightening the corn supply in the market, it is expected

that the corn starch price will climb up stably in China.

China’s corn starch price expected to rise

steadily in short term

Summary: Affected by the ongoing state

storage and purchase tightening the corn supply in the market, it is expected

that the corn starch price will climb up stably in China.

Due to the ongoing state storage and

purchase of corn, the market supply of corn is reducing. According to the

information released by the State Administration of Grain, as of 5 March, 2015,

there were total 110.41 million tonnes of new-harvested corns purchased by the

grain enterprises in 11 main corn producing areas in Hebei Province and

Heilongjiang Province, increasing by 6.48 million tonnes compared to the same

period last year. Along with processing enterprises restarting their

productions, corn spots are reducing and the producers’ inventories are also

declining. At present, due to the tight supply of corn spots coupled with the

increasing volume of state storage, enterprises need to raise the purchase

price of corns to maintain the raw material supply for production.

Regarding the whole industry, China’s

starch enterprises have suffered from losses for three consecutive years and

they are out of funds. Therefore, the enterprises with a large number of stocks

are relatively few and the stocking level remains low. Besides, after the

Chinese Spring Festival, starch enterprises recover production slowly and some

of them suspend production for a longer period than previous years, thus resulting

in the tight supply of corn starch in the market. Since 2015, China’s corn

starch price has kept rising steadily, from USD469/t to USD471/t. Under the

unsatisfied economic environment in 2014, the corn starch demand also remained

weak, which led to declining purchases and inventories of corn starch

processing enterprises. It is predicted that enterprises will start purchasing

corns since March 2015.

In view of the whole corn starch market in

March, the operating rate of domestic corn starch industry is gradually

increased to over 50% (45% in Feb.). Since there are still some enterprises

undergoing production suspension for overhaul, as time goes on, the operating

rate will further increase and the corn starch supply will be gradually

improved.

After entering into March, the prices of

corns in the ports of South and North China increase. The reasons are:

1. The ongoing state storage and purchase

of corns reduces the spot corns in the market;

2. Feed factories in South China strengthen

efforts to purchase corns in order to reduce the influence of the fluctuant

corn prices.

Additionally, in recent two months, the

snowy weather in Northeast China hinders the corn transportation, thus reducing

the supply of corn spots to some extent.

So far, the demands from the downstream

sectors of corn starch industry remain weak. For instance, the downstream

starch sugar, papermaking, food and fermentation enterprises do not restart

operations mostly, which causes unsatisfied transaction volume overall. These

downstream enterprises still consume the previous stocks currently and fewer

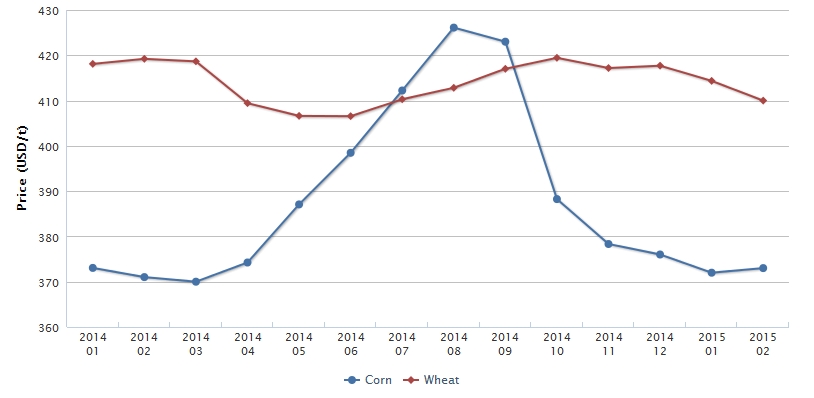

purchase raw materials (corn). It is worth noting that, wheat, as the

substitute of corn, occupied a large feed processing market instead of corn

based on its low price in 2014 (part of wheat producing areas suffered from

continuous rainy weather in 2014, resulting in serious germination). Moreover,

wheat is widely used in feed and alcohol production to replace corn, which to

some extent reduces the market demand for corn.

Although substitute enters into market by

dint of cost advantage, it makes little impact on the corn market since the

demands from downstream feed and alcohol sectors are relatively weak. In

addition, because the state storage and purchase of corn will last to April, so

the corn spots will continue to reduce. The stocking demand of processing

enterprises and the reducing corn spots create the conflicts. Therefore, CCM

predicts that the corn starch price will continue to rise in the future.

Due to the ongoing state storage and

purchase of corn, the market supply of corn is reducing. According to the

information released by the State Administration of Grain, as of 5 March, 2015,

there were total 110.41 million tonnes of new-harvested corns purchased by the

grain enterprises in 11 main corn producing areas in Hebei Province and

Heilongjiang Province, increasing by 6.48 million tonnes compared to the same

period last year. Along with processing enterprises restarting their

productions, corn spots are reducing and the producers’ inventories are also

declining. At present, due to the tight supply of corn spots coupled with the

increasing volume of state storage, enterprises need to raise the purchase

price of corns to maintain the raw material supply for production.

Regarding the whole industry, China’s

starch enterprises have suffered from losses for three consecutive years and

they are out of funds. Therefore, the enterprises with a large number of stocks

are relatively few and the stocking level remains low. Besides, after the

Chinese Spring Festival, starch enterprises recover production slowly and some

of them suspend production for a longer period than previous years, thus resulting

in the tight supply of corn starch in the market. Since 2015, China’s corn

starch price has kept rising steadily, from USD469/t to USD471/t. Under the

unsatisfied economic environment in 2014, the corn starch demand also remained

weak, which led to declining purchases and inventories of corn starch

processing enterprises. It is predicted that enterprises will start purchasing

corns since March 2015.

In view of the whole corn starch market in

March, the operating rate of domestic corn starch industry is gradually

increased to over 50% (45% in Feb.). Since there are still some enterprises

undergoing production suspension for overhaul, as time goes on, the operating

rate will further increase and the corn starch supply will be gradually

improved.

After entering into March, the prices of

corns in the ports of South and North China increase. The reasons are:

1. The ongoing state storage and purchase

of corns reduces the spot corns in the market;

2. Feed factories in South China strengthen

efforts to purchase corns in order to reduce the influence of the fluctuant

corn prices.

Additionally, in recent two months, the

snowy weather in Northeast China hinders the corn transportation, thus reducing

the supply of corn spots to some extent.

So far, the demands from the downstream

sectors of corn starch industry remain weak. For instance, the downstream

starch sugar, papermaking, food and fermentation enterprises do not restart

operations mostly, which causes unsatisfied transaction volume overall. These

downstream enterprises still consume the previous stocks currently and fewer

purchase raw materials (corn). It is worth noting that, wheat, as the

substitute of corn, occupied a large feed processing market instead of corn

based on its low price in 2014 (part of wheat producing areas suffered from

continuous rainy weather in 2014, resulting in serious germination). Moreover,

wheat is widely used in feed and alcohol production to replace corn, which to

some extent reduces the market demand for corn.

Although substitute enters into market by

dint of cost advantage, it makes little impact on the corn market since the

demands from downstream feed and alcohol sectors are relatively weak. In

addition, because the state storage and purchase of corn will last to April, so

the corn spots will continue to reduce. The stocking demand of processing

enterprises and the reducing corn spots create the conflicts. Therefore, CCM

predicts that the corn starch price will continue to rise in the future.

About CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content

solutions, from price and trade data to industry newsletters and customized

market research reports. Our clients include Monsanto, DuPont, Shell, Bayer,

and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in

touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.