On

1-3 March 2017, the biggest contributors of the agrochemical industry in China

and worldwide are gathering at one place, to place the tracks for the

agrochemical market in 2017. The 18th China International

Agrochemical & Crop Protection Exhibition (CAC 2017) will be held in

Shanghai. The event comes together with the 18th China International

Agrochemical Equipment and Crop Protection Equipment (CACE 2017) as well as the

8th China Fertiliser Show (FSHOW 2017).

These

exhibitions are an inevitable platform for all enterprises that do business in

the agrochemical market in China. They serve as the meeting point for

businesses to achieve trade, exchange, and cooperation with China’s agrochemical

players.

Source: Agrochemshow

After

those manufacturers, partly endured losses in profits throughout the year 2016, 2017

is seen by many experts as the downturn of the depressive market situation,

resulting in higher prices, increasing demand, and flourishing imports/exports. CCM, a Chinese market intelligence company with focus on China’s Agrochemicals

market, reveals the most important trends for the year 2017 and recommends,

what companies can expect from the CAC 2017 and do to achieve their goals in

the pesticides market in China, 2017.

The

CAC was first launched in 1999 and has become since then the world largest

agrochemical exhibition. After the depressing year of 2016, the exhibition

especially opens a window for the Chinese agrochemical enterprises to get their

food into international markets.

Market Situation 2016

The

market situation of pesticides in China in 2016 can be summarised as a

declining growth rate in revenues of many Chinese pesticides manufacturers,

combined with a globally weak market demand, and falling prices of pesticides,

which led to a depressed market situation in general. Chinese producers,

however, kept their production high, leading to even lower prices and an

oversupply status.

Common

crop diseases in China went down up to 20% for some occurrences, resulting in a

significantly lower prevention and control measurement of the government and

farmers and therefore in a weaker demand for pesticides. Additionally, China’s

plan of zero growth of pesticides consumption till 2020 and actions on

pesticides reduction and phytotoxicity control supported the weak demand for

pesticides in the past year. Technological advancements have replaced many old

pesticides which were used in a large amount of China’s fields

before, with high efficient, low toxic, and low residual pesticides as well as

high efficient crop protection machinery. These new methods need much lesser

use of pesticides in general, weakening the demand once more.

China’s

increasing efforts in environmental protection have forced several enterprises

to limit and shut down productions and implement expensive waste disposal

machinery, increasing the costs of these enterprises and lower their profits.

The demand for pesticides overseas was hovering on a low level, mainly due to

the El Nino weather phenomenon, which disturbed the agriculture in some

countries of South America and Africa. They normally show high demand for

agriculture protection commodities. Finally, a rising number of countries are

banning several pesticides for usage, decreasing the demand for them

enormously.

The

actual import and export data, according to CCM’s research, stated the

following value from January to October 2016:

Import

value: USD371 million, down 37.01% YoY

Export

value: USD4.51 billion, down 27.10% YoY

CCM

gives four reasons for the depressive export situation from China. The first

one is the global economic recession, leading to a slow economic growth, which

hurts China as the main pesticides exporter enormously. High costs and weak

profitability led to low development of pesticides in China. Thus, the quality

could not meet the one of competitors from countries like India, which got

market share from China’s pesticide export. Chinese manufacturers furthermore

faced high export barriers for pesticides in many countries, which their

low-quality pesticides cannot meet. Illegal trade of pesticides kept the price

of pesticides down and make fair competition very hard.

However,

the export decrease of pesticides in China slowed down in the second half of

2016 with expectations to rise again in 2017. Especially the export to South

Asian markets shows a lot of potentials. The exports in this region went up by

more than 11% YoY and achieved an export value share of almost 30% in H1, 2016.

Trend in 2017

According

to CCM, the pesticides industry in China will continue to recover in 2017 and

face an improved demand. The zero growth of pesticide consumption of China’s

government opens the doors for highly efficient, low toxic, and environmental

friendly pesticides as well as the development of them. Traditional pesticides,

which contain high toxicity and dangerous ingredients for the environment, are

going to be eliminated in the long run. The new environmental protection

policies will furthermore support an increasing demand for biopesticides.

It

is expected, that the total demand for pesticides in China will remain stable

in 2017, as long as no huge pest or disease outbreak will occur. The

expectation is based on the zero-growth goal for pesticides until 2020, which

leads to measurements in green prevention, pesticides reduction, and control

technologies. However, changing costs of agricultural production, less effort

of Chinese farmers for planting grains, raw material price fluctuations and environmental

protection measurements will lead to periodical and regional fluctuations,

which on the other hand will not have big extreme.

The

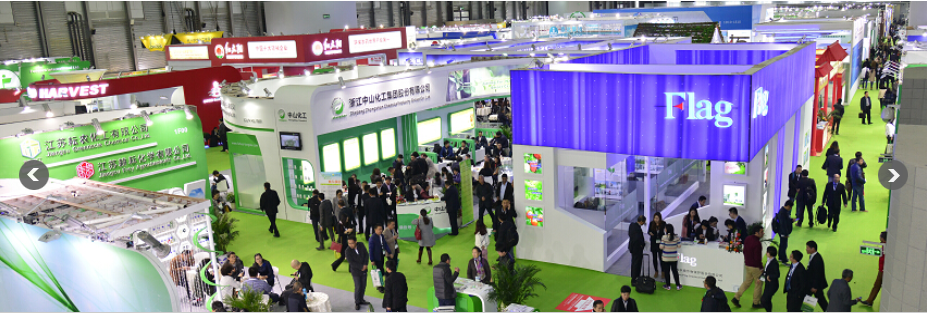

CAC 2017 will play a huge role in the development of the further agrochemical

industry in China. All big players will attend the exhibition, domestic and

worldwide. The exhibition contains over 60,000 square meters, offering place

for over 1100 agrochemical suppliers from over 20 countries and more than

30,000 industry professionals from over 120 countries.

Some

of the attending world leading enterprises are Dow Agroscience and Huntsman.

Chinese

leading manufacturers, that will attend, are Nutrichem International, Jiangsu

Huifeng, Sinochem International Corporation, and Shandong Binnong.

In

the year 2016, five factors have decisively influenced the pesticide enterprise

reform. These five factors are also the ones, that will have a massive effect

on the development in 2017.

Supply-side structural

reform

The

supply-side structural reform is the result of the depressed year for

pesticides in 2016 and the large overcapacity, which was facing minor demand.

The homogenous competition and the low profits of Chinese manufacturers have

then led to the implementation of the reform.

The

reform is encouraging manufacturers to increase their efforts in better

scientific research and innovation, strengthen the participation in market

share, have a better resource utilisation rate, and also enhance the overall

international competitiveness. As an outlook, industry insiders see in the core

content of the No.1 Document, a part of the supply-side structural reform which

will be released in 2017, a huge impact on the pesticides market in 2017.

The new Regulations on

the Administration of Pesticides

According

to CCM, the changes of the Regulations on the Administration of Pesticides are

affecting mainly the work management of the departments and implement stricter

requirements and punishments for nonobservance.

In

detail, one department will be responsible for one business, which represents a

reform of pesticide management. The supervision of the pesticides market will

be strengthened, increasing the responsibilities of manufacturers, makes the

use of pesticides significantly stricter, and raises the punishments for

nonobservant companies and enterprises. This includes a system, where

unqualified pesticide products need to be returned, reported and recalled.

This

new regulation is likely to clear the pesticides market in China in 2017 more

and therefore regulates the use of pesticides in general with an effect on many

upstream and downstream enterprises.

13th Five-year

Plan of the Pesticide Industry

The

13th Five-year Plan (2016-2020) focuses on the enhancement of China’s

industrial structure as well as the structure of products, technological

innovation, and sustainable growth. This goes by with more attention to food

security and international competitiveness.

CCM

has summarised the plan and filters out the main points. The plan can be

divided into five objectives, which are an industrial organisation, products,

the establishment of the innovation system, technology, and environmental

protection. The major tasks to achieve these goals include the change of the

industrial structure and focus on technological innovation. To strengthen the

control over the industry, China will enhance the macro-control. To keep up

with international competition, the safeguard measures will be more pragmatic

and improve stable and healthy development.

For

2017, the plan will continue to solve the typical problems of the pesticides

industry, like low concentration ratio, overcapacity, weak innovation, and bad

waste treatment.

2016 Special

Rectification Action Plan

The

Rectification Action Plan for Pesticides was implemented in April 2016 to

ensure more quality of agricultural products and protection of the environment.

The

plan is supposed to limit or completely ban the use of several pesticides in

China, which show high toxicities. It strengthens also the market supervision

to stop illegal pesticides and ingredients in legal pesticides. Finally, the

public shell is better informed about pesticides and clarified about the risks.

In

2017, the Ministry of Agriculture is likely to continue to implement the plan

and strengthen enforcement of relevant measures.

Pesticides advertising

law

The

policy about the pesticides advertising law gives only manufacturers of

registered pesticides the right to do advertisements. These advertisements,

however, have to be consistent with the pesticides registration certificate and

the pesticide registration notice.

The

policy makes sure, that the public opinion about pesticides is not misled.

Advertisements shell not contain scientific research recommendations, the image

of users to justify, claim the effectiveness, violate safety requirements, or

similar content.

This

policy supports the healthy, pragmatic, and rational development of the

pesticides industry in China, enhancing the rights of farmers and other users

to secure a sustainable environment.

The Belt and Road

The

export into developed countries is complicated for China since they are

favouring the interests of international agrochemical players with pesticide

residue standards, technical standards, and anti-dumping litigations.

This

is, where the project the Silk Road Economic Belt and 21st Century Maritime

Silk Road Initiative of the Chinese government is making a difference. More and

more Chinese pesticides manufacturers are turning their eyes and efforts onto

the countries alongside the silk road, enhanced by enormous development

opportunities. To confirm this outlook, also the Plan for Petroleum and

Chemical Industry Development (2016-2020) mentions the focus of the Chinese

pesticide manufacturers in increasing their production and find new markets in

the countries alongside the Belt and Road.

The

trend of China’s manufactures doing increasing business with companies from

Asian and Africa is mirrored in the attendance of the CAC 2016. According to

CAC, the share of companies from Asia and Africa has been over 53% combined.

Attendees from Europe have been about 18% and Attendees from North America just

around 7%.

Most

of the attendees are Manufactures with a share of 47% and second ones are

Importers and Exporter, achieved an attendee share in 2016 by almost 34%. The

statistic shows how important the exhibition is for Chinese manufacturers and

the importers and exporters to the deferent countries.

According

to CCM, the total export volume of pesticides in 2015 from China has been 1.51

million tonnes. This is the first decline in the last five years. The total

export value reached an amount of USD7.28 billion. Also, the import of

pesticides has experienced a decline with only 58,000 tonnes import 2015. In

2014 it has been still 67,000 tonnes.

Furthermore,

71.10% of the total export value of pesticides in 2015 belonged to 22 countries

alone. The rest 28.90% were exported to around 160 different countries. This

shows the high concentration of China’s pesticides export to a few amounts of

highly concentrated markets. According to China Customs, the top importer in

2015 has been The USA, Brazil, Australia, Argentina, and Vietnam. Except for

Australia, all of these importing nations have listed a decline in imports.

After

a deeper look into the 22 most important importers of China’s pesticides, a

huge amount of important agricultural countries is being visible. Two of them

are the biggest importers of pesticides, like the USA and Brazil. As a fact,

the global share of agricultural production is highly concentrated. According

to the Food and Agriculture Organization of the United Nations from a report in

2014, the share of the 10 most important agricultural producers of Soybeans,

Rice, Cotton, and Wheat is 95%, 83%, 81%, and 70% respectively.

Furthermore,

the report states, that the big agricultural nations also include countries

with few pesticides imports yet, like Bangladesh, Burma, Cambodia, Uzbekistan,

Turkmenistan, Kazakhstan, Ukraine, Tanzania, and Mali. Looking at a map it

becomes clear, that many of these nations are located on the Belt and Road.

However,

CCM has analysed the fastest growing importing nations of China’s pesticides in

2015 and states, that many of the promising big agricultural producers already

are in the list of the fastest growing importers of Chinese pesticides, like

Iraq, Kazakhstan, and Uzbekistan with a year on year growth in export value of

146.73%, 48.48%, and 46.50% respectively.

This

demonstrates, that the trend of Chinese pesticide manufacturers is already

going in the direction of emerging this markets. The trend is very likely to

even grow faster in the near future, with the support of China’s The Belt and

Road strategy.

Environmental

Protection

The

increasing efforts of China’s government in the fight against environmental

pollution has a huge effect on the Chinese pesticides industry in the coming

years.

As

a fact, the measurements of the environmental bureaus have improved the supply

situation of Chinese manufacturers to a huge extent. According to CCM, this

industry experienced a downturn from the second half of 2014 until 2016. This

trend is caused by many small and medium-sized enterprises leaving the market,

not able to afford the environmental-friendly waste treatment technologies, the

government is requiring. Other companies had to reduce or even cut down their

production temporarily, to keep the environmental pollution from the production

in a frame, not meeting the environmental standards. CCM predicts, that the

number of pesticide manufacturers in China will continue to shrink in the

future, due to the mentioned reasons. This all will enhance the supply-demand

situation in China furthermore.

The

Chinese government is increasing the efforts in environmental protection. This

also includes the enlargement of so-called pollutant discharge licenses, which

will have an effect on China’s pesticides industry. The measurements come into

action because the quality of air and water in many regions have not achieved

the standard value for a long time. The new regulations are stated in the

Environmental Protection Tax Law of the People’s Republic of China, which is

going to come into effect on 1 January 2018.

The

main idea of controlling the pollutant discharge are discharged licenses, that

requires mainly manufacturers with pollutant emission to be licensed until

2020. The goal of the licenses is to reduce and cut pollution, which will help

to achieve the standard value of quality for many regions again.

Although

a pollutant discharge licensing system was in action before, it turned out as

not very effective, due to an impractical placing of responsibility on

organisations and the lack of appropriate supervision by the environmental

protection departments, according to CCM.

The

new system is supposed to clear out past vagueness and will be supervised more

strictly. CCM has listed the key measures:

First

of all, the system changes from an administrative area pollutant discharge

system to a certain organisation affecting one. The applications for licensing

should be done before the actual project construction, which serves as a

reference for the planned regular environmental checks. It also allows

authorities to monitor pollution in advance.

The

management of the licensing management requires a catalogue, created by the

environmental protection departments, about the pollutant discharge. This will

be accordingly changed to the different type of industries and their impact on

the environment. The Organisations can then apply for the license by stating

their pollution variety, amounts, and concentration.

The

governmental departments are requested to do inspections more frequently,

according to the pollution emission of companies, and get the rights to punish

blunder with production limitation, suspension, and shutdown. On the other

side, the licensing system encourages organisations to give themselves stricter

pollution limits, which can be regarded by preferential electricity prices and

governmental preference.

This

newly implemented license will be the only permission for organisations to emit

any pollution. Every other method will be illegal. The licenses will be granted

for three years in the first place and five more years after every renewal.

Bio-pesticides

Bio-pesticides

are in the focus of the Ministry of Agriculture of China and the Ministry of

Environmental Protection of China. Therefore, the registration of biopesticides

is highly supported in the recent years. Some of the benefits of the

registration of bio-pesticides in China are cut down efficacy test times of the

pesticides from two years to only one year and hence a cut down of the whole

registration time.

Also,

customers and farmers are paying greater attention to the new more

environmental friendly substitutions of pesticides for their products. This

reveals a promising option for manufacturers and traders.

Looking

at the year 2015, bio-pesticides were accounted for 10% of China’s total

pesticides market. The trend is expected to go upwards, while more and more

traditional pesticides will be replaced by bio-pesticides. CCM predicts, that

the supply and demand for bio-pesticides in China are going to increase

remarkably in the years 2017-2020.

However,

manufacturers of bio-pesticides need to put the effort in marketing and

branding to convince the Chinese farmers of the benefits of their products,

considering they are still preferring the conventional way of crop protection.

Chinese producers are concentrating their sales more on the overseas market at

present, looking at markets like Europe, where bio-pesticides are gaining a

market share of around 20% of total pesticides.

What’s

more, bio-pesticides are also in the focus of the CAC 2017 in Shanghai. The

18th China International Agrochemical & Crop Protection Exhibition in

Shanghai will be an inevitable event for all companies that are dealing with

their pesticides business in China. The exhibition will be held on March 1-3,

2017 with more than 70,000 square meters of area. The organisers are expecting

about 30,000 visitors from over 120 countries.

The

CAC has become the largest agrochemical exhibition in the world, representing

the largest platform of agrochemical products from pesticides, fertilisers,

seeds, to manufacturing and logistic.

Recommendations for

manufacturers and traders in 2017

Enterprises

that are active in the Chinese market should follow some of the following steps

to ensure a good business in 2017:

Chinese

farmers are preferring pesticides from overseas, because they have a better

reputation, higher quality, and the producers enjoy a goodwill. However, domestic

distributors of pesticides are often bad trained and don’t know how to

effectively sell the products. Giving ones’ domestic supplier some training in

effective sales will become a key factor for future marketing trends. Also,

some benefits for the peasants, like preferential cards, coupons, and

multi-channel marketing, will help to build healthy relationships in China and

get market share.

The

sales team will play one of the most important roles to drive the revenue. At

the current state, most of enterprises have only one sales person responsible

for a region or province in China. However, this sales person needs to deal

with market development, customers management, fund collection, explanation of

technical knowledge, execution of the marketing plan and more. To build

long-lasting relationships, a team of several sales person is necessary, to

deal with the clients directly and not get overwhelmed by a broad spectrum of

tasks Furthermore, sales teams should keep an eye on whole China, able to

switch between northern and southern China, when the peak seasons are changing.

An

implementation of a management platform will ease the daily life of sales

persons in China immensely. This platform needs all the information for the

different sales teams, including promotion of terminal stores, management of

sales persons, and promotion of new products. This will help the marketing of

the sales person and ease time.

Finally,

companies have a huge advantage when visiting the CAC 2017 on 1-3 March 2017,

to meet China’s top manufacturers and traders in Agrochemicals. This opens

possibilities to build the brand awareness, generate new sales and leads,

educate their buyers and keep connections growing.

Meet CCM at the CAC 2017 in Shanghai. We are at booth number 4B55.

Simply visit us or arrange a meeting by contacting Patrick.schreiber@kcomber.com.

About CCM:

CCM is the leading market intelligence provider for China's agriculture, chemicals, food & ingredients, and life science markets.

Do you want to find out more about the agricultural market in China? Try our Newsletters and Industrial Reports or join our professional online platform. For more trade information of corn, including Import and Export analysis as well as Manufacturer to Buyer Tracking, contact our experts in trade analysis to get your answers today.