China

is the globally leading country in R&D of biopesticides. However, due to

the lack of awareness of China’s farmers, the consumption is lacking behind the

huge potential. Market intelligence firm CCM predicts a surging consumption of

biopesticides in China in the close future, backed up by increasing promotion

of manufacturers and measurements of the government to support the trend.

Source: Pixabay

As

a part of China’s plan of zero growth of pesticides consumption till 2020, more

effort is set for the development of biopesticides to lessen the dependence on

harmful chemical pesticides and enhance sustainable agriculture in the second

largest agriculture of the world. Hence, the topic is becoming widely mentioned

in China, for example in the recently issued Catalogue of Key Products and

Services in Strategic Emerging Industries (2016). The issue, published by the

National Development and Reform Commission of the People’s Republic of China,

investigates 8 industries including equipment manufacturing and the bio

industry. The development of biopesticides is one of the topics in the

catalogue.

According

to CCM, the share of biopesticides in China of the use of total pesticide was stated at

1.7% in 2014. This tiny share even represents a drop by 0.11% points compared

to 2010, where the share of biopesticides reached 1.81%.

However,

the reason for the lack of biopesticides use in China can’t be found in the

lack of research. As a fact, China has recently claimed the first rank in the

field of biopesticides research and development worldwide. As a result, the

country already possesses a complete system of biopesticides, including

microbial pesticides, biochemical pesticides, botanical pesticides,

agricultural antibiotics, and biological pest control, according to CCM’s

research.

The

main problem in the development of biopesticides in China lays in the

commercialization of potential products. China’s research institutes are

working very theoretical without a real connection to the industry itself.

Hence, many of the theoretical approved potential products never find the way

out of the lab into real development. This represents a huge difference to

other developed countries, who work closely with the pesticides industry and

are able to bring many of their research results into market launches.

Despite

the relatively weak commercialization, China’s registration of biopesticides is

rising continuously. Especially the registration of microbial pesticides is

facing a large increase in the current time.

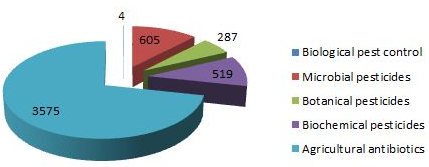

Valid

registrations of biopesticides in China, as of early Feb. 2017

Source:

Institute for the Control of Agrochemicals, Ministry of Agriculture

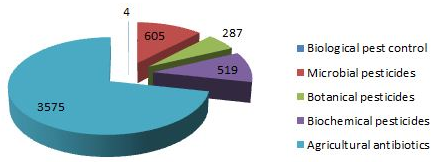

Number of

biopesticide formulations applying for field tests in China, as of early Feb.

2017

Source:

Institute for the Control of Agrochemicals, Ministry of Agriculture

The

biggest problem for China’s pesticides manufacturers is the low awareness among

Chinese farmers regarding the use and benefits of biopesticides. Such farmers

are still poorly informed about the right use of pesticides for their crops,

which leads to the use of highly dangerous pesticides for the wrong crops and

the wrong usage in sight of the amount, security and frequency. This is where

China’s manufacturers are trying to break into the market with new services and

education.

As

a matter of fact, many manufacturers in China have elevated their efforts to

promote bio pesticides to the farmers. According to CCM’s research, Jiangxi New

Dragon Biotechnology Co., Ltd. and Jiangxi Tianren Ecology Co., Ltd. developed

a brand new “biopesticides + agricultural aviation services” business pattern,

which not only meets the demands of Chinese farmers but also is promising to

generate great profits to distributors.

In

the meanwhile, the Chinese government has also implemented a series of

beneficial policies for the biopesticide business. Besides to the previous

bespoke issue of the Catalogue of Key Products and Services in Strategic

Emerging Industries (2016), the Highlights for Crop Farming Industry 2017,

released by the Ministry of Agriculture of the People’s Republic of China, also

deals with the development of bio-pesticides in China and as a result put

forward the expansion of the pilot subsidisation program for low toxicity

biopesticides.

With

the increasing effort of manufacturers and government, the pesticides industry

in China is likely to make great use of the use potential of biopesticides

soon, which offers great opportunities for foreign sellers and investors to get

a piece of the cake in China’s growing market.

GFIA 2017

What’s

more, the Global forum for innovations in agriculture (GFIA 2017) will be held

on May 9 – 10 in Utrecht, the Netherlands. This special event is famous for

being dedicated to showcasing innovations in sustainable agriculture across all

types of food production. Furthermore, the GFIA brings together stakeholders

right along the value chain to facilitate collaboration at large. At all,

GFIA’s consists of a global network of 40+ partners and a major component of

the audience will come from the emerging markets of Africa and Asia.

Whether

you want to increase yields, save water, improve livestock health, or meet the

challenges of climate change, there are hundreds of solution providers

exhibiting at GFIA Europe with working products to help you improve the

productivity of your farm, agri-business or sustainable agtech programme.

Visit the exhibition to meet representatives of global players like Bayer AG,

the Coca-Cola Company, Syngenta, and CEMA - European Agricultural Machinery.

As

an exhibition dedicated to sustainable development of agriculture, all kinds of

innovations in biopesticides will we recognised with huge interest, which is a

great opportunity for manufacturers or traders of biopesticides worldwide.

About CCM

CCM

is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets.

Do

you want to find out more about the biopesticides market in China? Try our

Newsletters and Industrial Reports or join our professional online platform today and get insights in Reports, Newsletter, and Market Data at one place.

For

more trade information of pesticide products, including Import and Export

analysis as well as Manufacturer to Buyer Tracking, contact our experts in trade analysis to get your answers today.

Looking

for a convenient way to get comprehensive and actual information as well as a

platform to discuss with peers about the latest agrochemicals industry and

market trends? Simply subscribe to our YouTube Channel and join our groups on LinkedIn and Facebook.