Our team takes part in

the 19th China International Agrochemical & Crop Protection Exhibition (CAC

2018) in Shanghai. Known to be one of the research and opinion leaders of the

Chinese agrochemicals market, Kcomber’s General Manager Usman Khan has given a

presentation on the first day at the 9th China International Fertiliser Show

(FSHOW 2018), that comes together with the CAC. In the speech, he outlined the

development of China’s fertiliser industry to the crème a la crème of China’s

fertiliser leaders and gave recommendations of how to deal with the

development.

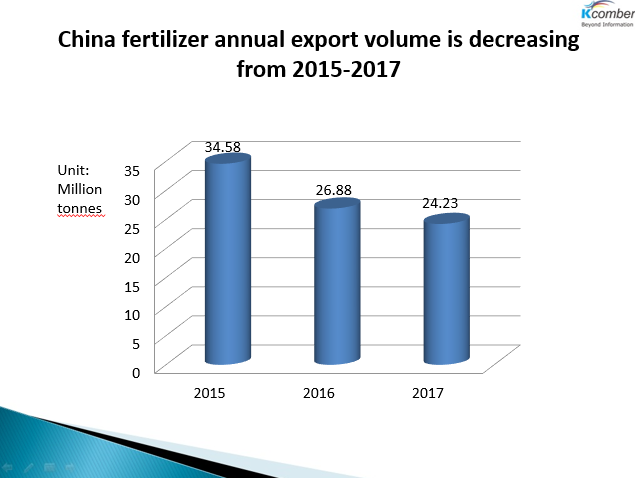

Mr

Khan started the presentation with an overview of China’s fertiliser industry

from 2015-2017. During this period, the market saw year-by-year falls in

fertilisers export volume from China.

Source: CCM

According

to Mr Khan, there are several reasons for the development. First of all, the domestic supply and demand situation.

Large quantities of obsolete production capacities were phased out for the

supply-side structural reform carried out by the Chinese government.

Preferential policies for fertiliser production were removed and the demand

fell stably, due to the Proposal to

Take Actions to Achieve Zero Growth in Fertiliser Use by 2020 unveiled

by the Ministry of Agriculture of the People’s Republic of China. Lastly,

production cost was increased because of the inspection for environmental

protection mainly.

The trade structure is

another reason. China mainly exported basic fertilisers such as urea and

phosphate fertiliser, which were disadvantaged for their high cost and poor

competitiveness. By contrast, the urea business in the USA developed

vigorously, based on the large-scale production of shale gas. From 2016-2017, a

total production capacity of 3.70 million t/a was constructed in the USA, and

the figure will rise further by 360,000 t/a in 2018. The USA may change its

role, from a large urea importer to an exporter, according to Mr Khan’s

insights. In addition, OCP Group exploited its advantages in phosphorus

resources to the full and expanded its production capacity. In 2018, another

800,000 t/a phosphoric acid production line is to run, and its production

capacity of granular phosphate fertiliser will surpass 12 million t/a. The

significant expansion in fertiliser production capacity and the fiercer

international competition are increasing threats to China’s traditional

fertiliser business.

Under

such circumstances, domestic fertiliser

makers are expected to go abroad, so as to give full play to both domestic

and foreign markets, is the result of Mr Khan.

Where to go: along Belt

and Road

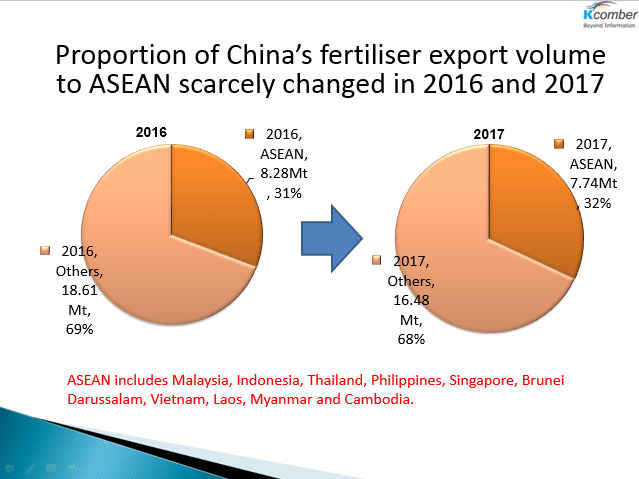

As

the next topic, he spoke about the role of the Belt and Road project in the

fertiliser industry. South Asian and

Southeast Asian countries along the Belt and Road are targets in particular.

Their agriculture businesses, which demand many agricultural means of

production (AMP) such as fertiliser, still play a vital role in their national

economies. Their fertiliser outputs are low, restricted by the economic

conditions, production facility and technology and soil management.

Specifically, they import large quantities of nitrogenous fertiliser, phosphate

and compound fertilisers and potash fertiliser. Hence, they are the first

choices to the domestic fertiliser business. According to China Customs,

China’s exports of fertilisers to the countries under the Association of

Southeast Asian Nations increased in 2016 and maintained stability in 2017,

despite falls in the national totals. It is of great significance to export the

domestic advanced fertiliser and pesticide production facilities, production

technologies and quality products to the countries along “B&R” (strong

demand, short shipment distance and low shipping cost, if the domestic AMP

suppliers intend to achieve internationalised development.

Source: CCM

How to go abroad: to

develop new products and new technologies with a focus on compound fertiliser

According

to Mr Khan, the domestic fertiliser business is not aimed at earning foreign

exchanges through exports but instead is to guarantee the domestic agricultural

production, especially to ensure the long-run and sustainable production of

grains. In 2017, the Chinese administration issued the “zero tariffs” policy on

part of the fertilisers, a move intended to get the business out of trouble.

This policy will continue in 2018, so as to manage the conflict brought by the

full-year production and the seasonal demand.

Furthermore,

the export of fertilisers is mainly to

protect the business and the production capacity, he explained next. For

one thing, idle production lines may run and the economic effect may be

achieved when it is the off-season. Such a continuous production will enable

enterprises to reduce costs and better solve problems in environmental

protection and safety. For another, if an enterprise has relative overcapacity,

it is capable of flexible supplies. This will contribute to better protection

of domestic agricultural production.

The

export of compound fertilisers is very different from the export of either urea

or phosphate fertiliser, as compound fertilisers are of high added-value. This

business will export technology, services, talents and even brand image, in

addition to product. By contrast, exports of both urea and phosphate

fertiliser are only exports of bulk commodity.

Under

this, the export of compound fertilisers

is much more profitable than that of urea and phosphate fertiliser which face

homogenization. It is notable that this business must be supported by

strong technical teams and agrochemical services and must be tightly connected

with local agricultural production abroad. During this, the domestic fertiliser

enterprises will build their images in the world and many well recognised

multinational enterprises will emerge, like Kingenta Ecological Engineering

Group Co., Ltd., Stanley Agriculture Co., Ltd., Shenzhen Batian Ecological

Engineering Co., Ltd. and Shandong Hongri Chemical Joint Stock Co., Ltd.

The

tariff policies which are increasingly favourable for the export of compound

fertilisers have been issued in recent years. This also gives impetus to the

development of the domestic compound fertiliser business. Compared to developed

countries, China-made fertilisers are composited in a relatively low way.

However, the development of high-efficiency, labour-saving compound fertilisers

has become a trend in the world. It is expected that the favourable policies

issued will encourage the domestic enterprises to make greater efforts to

develop technologies related and to carry out production, and meanwhile to lead

the domestic fertiliser business to make transformation and upgrading.

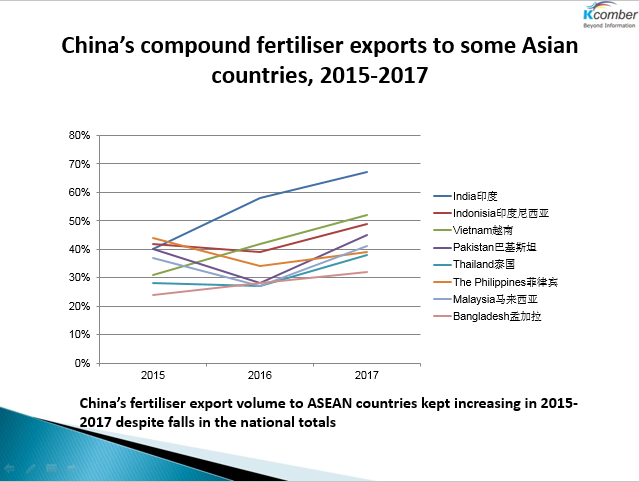

Source:CCM

According

to China Customs, Mr Khan outlined in front of the audience, compound fertiliser has made up an

increasing proportion of the national total exports of fertilisers which

have decreased for years. Reportedly, Thailand imports 1 million tonnes of

compound fertilisers annually and the average annual growth rate of Vietnam’s

compound fertiliser consumption is approximately 5%. Meanwhile, the overall

consumption of compound fertiliser is estimated to further increase thanks to

the enhanced public awareness of balanced fertiliser usage. Obviously, it plays

a decisive role in the domestic fertiliser export business. Hence, it is a key

way for the domestic fertiliser enterprises to develop a succession of new

products, new technologies and new businesses with a focus on compound

fertiliser if they intend to go abroad.

Leading enterprises

going abroad

According

to Mr Khan, Kyrgyzstan-based fertiliser plant with an investment of USD200

million made by Hebei Baidoujia Fertiliser Co., Ltd. is to be constructed soon.

It is to produce over 600,000 tonnes of fertilisers such as urea, phosphate

fertiliser and compound fertiliser per year. In addition, the company planned

to take this opportunity to penetrate into the local seed, pesticides and

agricultural machinery businesses and to facilitate the integration of grain

deep processing and livestock breeding.

Jiangsu

Huachang Chemical Co., Ltd. have for consecutive 3 years ranked 1st regarding

the exports of compound fertiliser from China. In order to expand the shares in

the international market and spread the domestic experience on fertiliser

business development, the company has set up a joint venture in Malaysia, which

is aimed at promoting formulated fertilisers based on nitrogen, a byproduct

from the production of ammonium chloride and ammonium sulphate. Meanwhile, the

company has established a team with domestic key players such as Henan Jinshan

Chemical Co., Ltd. to make demonstrations and carry out tests and promotions of

fertilisers and to share the domestic experience on soil test based formulated

fertiliser in the countries and regions along the “B&R”.

Hubei

Xinyangfeng Fertiliser Co., Ltd. is now selling its products worldwide. In the

past 12 years, it has stepped into 30+ countries and regions in Asia, America,

Oceania and Africa and its portfolio spanning granular mono-ammonium phosphate,

powder mono-ammonium phosphate and nitrogenous and phosphate compound

fertilisers, has been marketed widely. Besides, it has acquired Australia-based

Kendorwal Farm, a move into the world’s premium agricultural and animal

husbandry business. Now the company is clear about its international strategy:

that is, to achieve internationalisation of technology, production capacity,

trade and resources and to go globalised.

Kingenta,

as a leading enterprise in the domestic new type fertiliser business, plays a

benchmarking role in view of all-round internationalisation. Recent years have

witnessed: 1) its acquisitions of and share-participation into many world’s

well-known enterprises which are involved in agricultural business, such as

Germany based COMPO EXPERT GmbH; 2) its construction of branches in many

countries and regions including the US, Australia, India, Spain, Norway,

Israel, Germany, the Netherlands, Vietnam and Singapore; 3) its establishment

of partnerships with 7 foreign universities such as University of Florida and

Norwegian University of Life Sciences and 3 test stations under the United

States Department of Agriculture, in addition to its business activities in the

domestic 10+ bases.

As

the conclusion for the presentation, Mr Khan suggested, the domestic fertiliser enterprises should take

technology innovation as a fundamental strategy in their sustainable

development, pay close attention to development trend of the international

fertiliser business, increase the development of new products and new

technologies and the transfer of scientific achievements, and strengthen the

reform on supply side. All these will help the enterprises establish a

technology innovation system combining them with industry, academia and

research, build international images and brands, win consumers around the world

and gain recognition worldwide.

About CCM:

CCM

is the leading market intelligence provider for China's agriculture, chemicals,

food and feed.

Do

you want to find out more about the agricultural and agrochemicals market in

China? Try our Newsletters and Industrial Reports or join our professional

online platform.