In 2024, the global demand for fertilizers is showing a

sluggish trend.

According to the new report of RaboResearch, in 2024, the

demand for fertilizers did not maintain the growth trend of 2023. Instead, it

remains in a sluggish state.

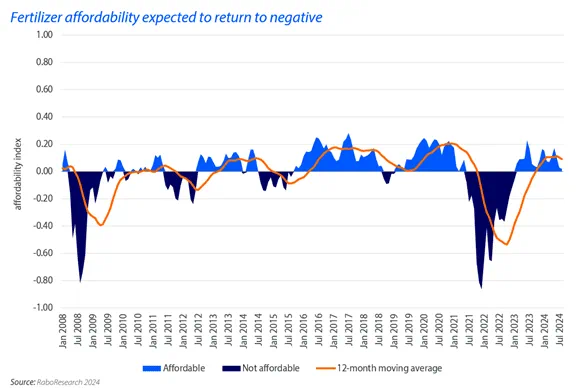

Not only that, as farmers' operating profit margins are

facing pressure, the report predicts that the fertilizer affordability index

will turn negative from a balanced state in the second half of this year.

However, Bruno Fonseca, a senior analyst of agricultural

inputs, analyzed that due to the increase in fertilizer prices and the pressure

on farmers' operating profit margins caused by the sluggish prices of

agricultural commodities, it is expected that the growth in fertilizer demand

will not return to the level of 2023 within the next six months.

In addition, Fonseca also said that the prediction of strong

global crop production continues to put pressure on the commodity market, thus

leading to a drop in market prices and further reducing farmers' operating

profits.

The prices of nitrogen fertilizers and

phosphate fertilizers being higher than the historical average is also an

important reason for the reduction in farmers' profits.

Under the combined effect of these factors, farmers' ability

to purchase fertilizers will become low.

Phosphate fertilizer

In recent months, the market's affordability for phosphate

has significantly deteriorated due to the increase in fertilizer prices of

monoammonium phosphate and diammonium phosphate as well as unfavorable

commodity prices.

The reduction in global phosphorus market supply may push the

price of phosphate fertilizers above the historical average. This is precisely

because the strategies of the three major exporting countries have changed.

In China, from 2018 to 2021, about 9

million tons of monoammonium phosphate/diammonium phosphate were exported

annually. From 2022 to 2023, the average export volume decreased to 6.3 million

tons.

By April 2024, China's phosphate fertilizer production had

returned to the previous level, but the price did not fall either.

And the United States has changed its phosphate market

strategy. While reducing the import and export of monoammonium

phosphate/diammonium phosphate, it has increased the import of phosphate rock.

From 2021 to 2023, the United States exported about 1.26

million tons of monoammonium phosphate/diammonium phosphate, which accounted

for only 20% of the export volume from 2018 to 2020. Therefore, it can be

expected that the export volume will continue to decrease in 2024.

Morocco has also changed its strategy. Since 2018, Morocco

has significantly reduced the export of phosphate rock and at the same time

increased the export of monoammonium phosphate and diammonium phosphate. The

export volume of phosphate rock has decreased from 11.2 million tons in 2018 to

4.5 million tons in 2023.

Nitrogen fertilizer

Under the condition that urea prices fluctuated

due to supply issues at the end of June, the affordability index of nitrogen

fertilizer still remained stable.

Here are several uncertainties caused by

factors.

First is in Europe.

Urea prices have been on a downward trend.

However, it was not until the news of Egypt stopping production due to natural

gas supply issues in mid-June 2024 that, in turn, pushed urea prices to rise by

17% in just one month.

In addition, natural gas prices in Europe have

risen this summer, from 31.4 euros/MWh in mid-July to 39.6 euros/MWh on August

15.

Due to concerns about price fluctuations,

European buyers are hesitant when purchasing urea, directly leading to weak

demand in this region.

Then there is Brazil.

In Brazil, farmers are focusing on purchasing

fertilizers such as urea for planting safrinha corn crops. However, fertilizer

prices are rising, making fertilizer demand in this region difficult to

predict. But import data from July shows that from January to July this year, Brazil

imported 3.6 million tons of urea, which is 3% higher than the average level of

the past five years.

Finally, there is India.

As the largest provider of liquidity in most

fertilizer markets including nitrogen fertilizer, there is news that its inland

inventory may be higher than normal levels. This may also lead to a reduction

in India's demand for new tenders or even a delay in tenders.

Potassium fertilizer

The affordability index of potassium fertilizer

improved slightly in July. The decline in fertilizer prices offset the negative

impact of the deterioration in commodity prices.

In Rabobank's report, the optimistic outlook for

potassium fertilizer is affected by the recent procurement contracts of China

and India as well as the saturated demand in Brazil.

It is reported that China and India are

negotiating to reduce the procurement price by 12% compared to the currently

paid price, but this is a disadvantageous factor for potassium fertilizer

prices in other regions.

And Brazil has negotiated for new production

below $300 per ton. Brazilian importers who have obtained large discounts have

purchased a large amount of potassium fertilizer this year. According to data

from January to June 2024, the amount of potassium fertilizer imported by Brazil

reached 6.9 million tons, which is 1.6 million tons more than the average

import volume in the past five years.

In general, the price of potassium fertilizer

has decreased, but it is not entirely good news.

The report predicts that the price of potassium fertilizer

may become very low in the future and may even approach the operating costs of

fertilizer companies. This may ultimately lead some companies to reduce

production to avoid losses.

RaboResearch has also made a prediction that fertilizer

demand will experience a small amount of growth in the next two years.

Phosphate fertilizer demand will continue to be

under pressure in 2025. Although there is a growth trend in 2026, the growth

rate is not significant.

Nitrogen fertilizer demand will continue to

recover in 2025, but at a relatively slow pace. It will experience a slight

rebound in 2026.

The demand for potassium fertilizer has already

rebounded moderately in 2024. The growth rate will slow down in 2025 and will

increase again in 2026.